Breaking Down the Common Intraday Trading Mistakes in Bank Nifty

Avoiding Common Intraday Trading Mistakes in Bank Nifty

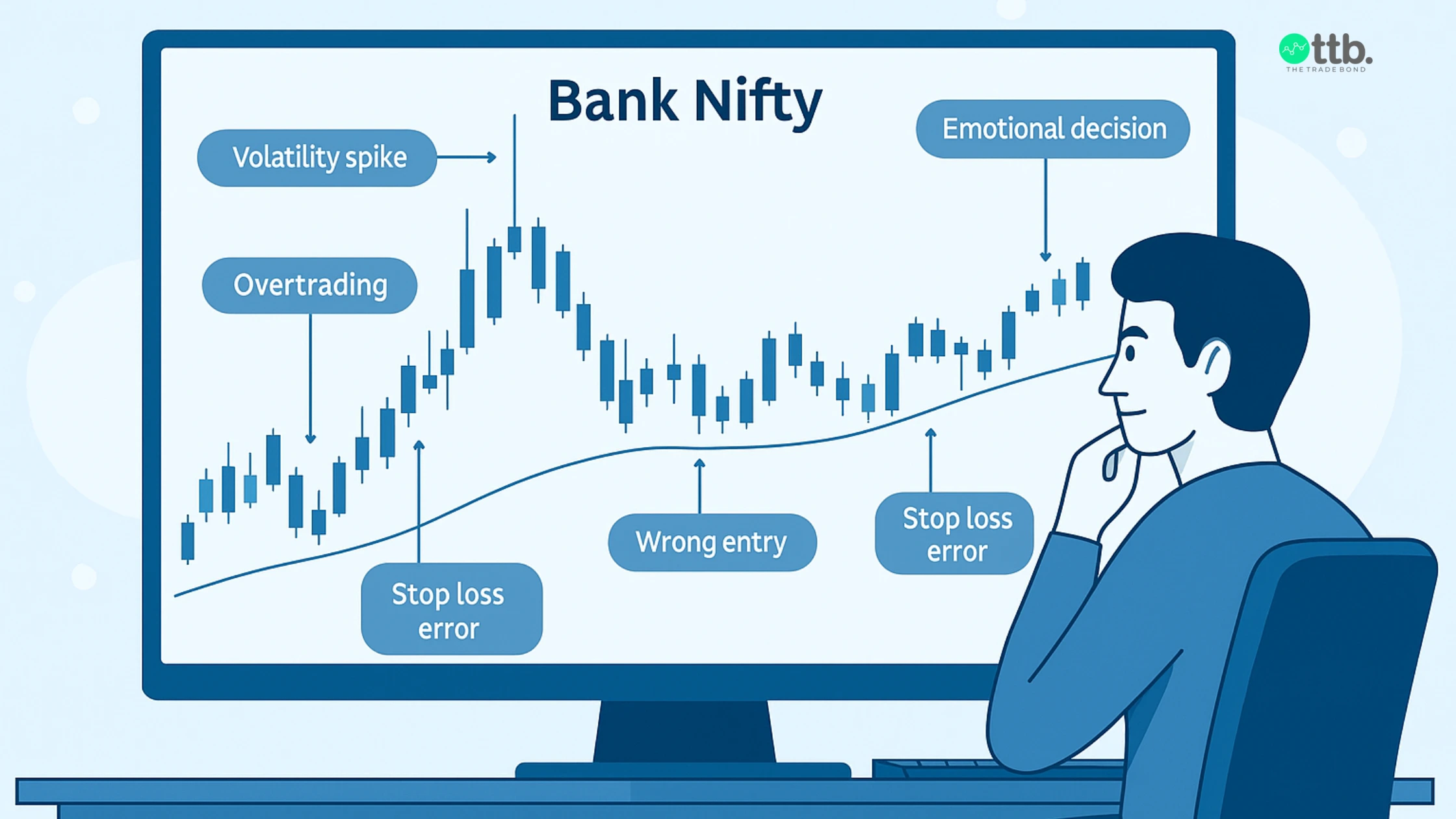

Intraday trading in Bank Nifty attracts active traders because of its quick price movement and clear reaction to banking sector news. However, many traders repeatedly fall into the same patterns that lead to losses or sometimes miss opportunities. Also, the most common intraday trading mistakes in Bank Nifty happen due to no planning, unclear entry rules, and a misunderstanding of index behavior.

In simple terms, Bank Nifty intraday trading means buying or selling positions within the same day based on levels, patterns, and market structure. When traders understand what impacts Bank Nifty, such as banking stock weightage, volatility spikes, and sentiment. Also, they gain more clarity in their daily decisions.

Why Intraday Trading Mistakes Happen in Bank Nifty

Bank Nifty moves quickly during opening hours, news announcements, and global market reactions. Many traders enter positions because of excitement or fear of missing out. Decisions become reactive if you don’t study the index structure or understand how major banks influence movement.

For example, when ICICI Bank or HDFC Bank shows unusual volatility, Bank Nifty follows immediately. If traders don’t track such weightage changes, they might misread the direction. To get more clarity, you can also explore our blog on understanding the weightage of Banks in the Bank Nifty index for more information.

These gaps in presentation form the base of many common intraday trading mistakes in Bank Nifty.

Overtrading in Bank Nifty During High Momentum Moves

Overtrading usually happens when traders react to large green or red candles, expecting the move to continue. Bank Nifty frequently creates sudden spikes during 9:15 AM – 10:00 AM and during RBI-related updates. Also, overtrading generally comes from:

- Entering immediately after a big candle without confirmation

- Chasing momentum

- Taking multiple trades within minutes

For example:

A trader enters long after a wide candle at 9:20 AM, expecting continuation. But Bank Nifty retraces sharply after early excitement. Therefore, it leads to unnecessary entries and emotional decision-making.

Entering Trades Without a Defined Bank Nifty Setup

One of the major common intraday trading mistakes in Bank Nifty is entering trades without a proper entry setup. Many trades happen because the price looks strong instead of following rules. A proper setup includes:

- Direction

- Entry zone

- Stop loss

- Confirmation candle

- Exit area

Example:

A trader short-sells during a pullback without waiting for rejection. The pullback continues, reversing the entire trade.

Traders who want structured frameworks can explore how to do intraday Bank Nifty options trading.

Not Using Stop Loss Correctly in Bank Nifty Intraday Trades

Stop-loss is very important in Bank Nifty because a 50-80 point move can happen within seconds. Below are some of the mistakes included:

- Not placing SL

- Shifting SL after entry

- Placing SL too close

Example:

A trader keeps updating the stop-loss during a reversal because they hope that the price will return again. Also, Bank Nifty extends the move and hits a larger loss.

Using a structure-based Stop-Loss that is combined with candle patterns and levels helps maintain clarity during volatility.

Trading Bank Nifty Without Understanding Lot Size Impact

Many traders select lot sizes based on excitement instead of risk tolerance. Bank Nifty’s lot size can heavily influence margin, emotional pressure, and exit decisions.

Example:

If a trader enters with multiple lots, even a small move against them feels stressful. This leads to early exits or fast decisions.

Selecting a lot size based on personal risk limits supports more stable decision-making during Bank Nifty intraday sessions.

Trading During Unpredictable News Events

Banking updates, policy announcements, and global cues create unpredictable candles. Entering positions during such moments leads to sudden, unplanned outcomes.

Here, you have to understand when to avoid trading:

RBI announcements

Bank earnings

Sudden global index movement

Policy-related press conferences

You should wait for the market to settle, which gives a clearer structure and reduces unnecessary risk.

How Lack of Patience Leads to Wrong Bank Nifty Trades

Patience is a key factor in daily Bank Nifty trades. Because many traders enter early, exit early, or avoid waiting for retests.

Example:

A breakout happens when the traders enter instantly. But most Bank Nifty breakouts retest the level before continuing. Entering early results in wrong trades.

If you want more clarity on these mistakes, check out our 7 common mistakes Bank Nifty traders make today to understand briefly about the mistakes made by traders.

Daily updates, like Bank Nifty tips and Bank Nifty tips provider from The Trade Bond, also help traders understand structure-driven levels instead of reacting emotionally.

Quick Checklist to Avoid These Mistakes

Do’s:

Wait for candle confirmation

Track volatility and major bank influence

Use structure-based stop loss

Choose a lot size based on risk

Don’ts:

Enter during unpredictable news

Chase momentum

Make early entries without structure

Shift stop loss emotionally

The Trade Bond's View

At The Trade Bond, as a SEBI registered advisor, our view is clear, and most Common Intraday Trading Mistakes in Bank Nifty can be reduced when traders follow a structured method. Bank Nifty demands discipline, clarity, and patience. When traders track key banks and manage lot size, they should wait for confirmation and use defined setups. Also, their intraday approach becomes more consistent. Through our daily insights, such as Bank Nifty tips today, we aim to support traders in building a more organized and informed routine for their intraday decisions.

FAQ's

How do I avoid intraday trading mistakes in Bank Nifty?

You can avoid mistakes by using stop-loss, following a clear intraday strategy. Also, you can manage position size and avoid emotional trades.

Why do traders lose money in Bank Nifty intraday trades?

Traders lose money mainly due to poor risk management, lack of discipline, and trading without confirming price levels or trend direction.

Is stop-loss important in Bank Nifty intraday trading?

Stop-loss protects your capital, controls risk, and helps prevent large losses during volatile Bank Nifty moves.