Nifty Option Tips - Enhance your Intraday Trading Experience

Get Nifty Options Tips from a SEBI-registered investment Advisor. To enhance your trading experience we are here to guide you.

Let advisor assist you

How Does Our Nifty Tips Work?

Nifty tips are short-term trading signals that help investors to buy/sell stocks and to minimize potential loss. Basically, Nifty Tips refer to stock market recommendations based on the Nifty 50 Index. These tips are offered by financial advisors or experts of the stock market to help clients to make informed decisions. Those tips are helpful for the clients about buying/selling or holding Nifty 50 stocks.

How We Generate Nifty Option Trades?

Nifty Option trades are analyzed by our experts using technical indicators and news. These trades are based on whether is bullish or bearish, iron condor, strangle. Also by choosing right call or put options, by selecting strike price like ATM, OTM, and selecting expiry date. Applying strategies like spreads based on risk appetite which helps traders to gain profits.

Our Step-by-Step Research Process

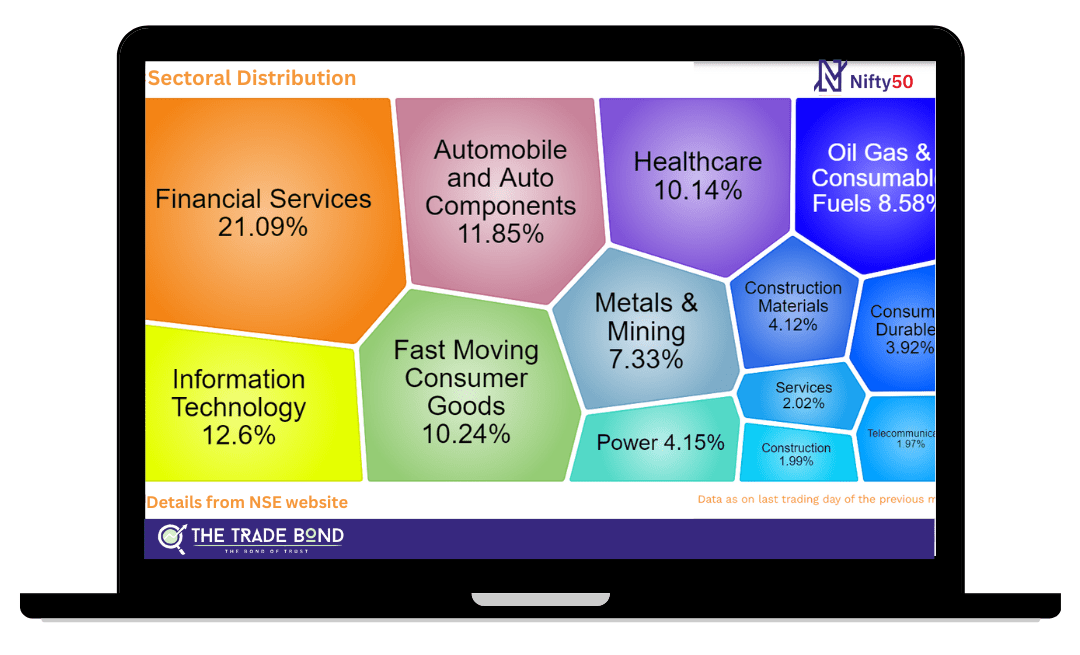

Stock Selection Based on Nifty 50 Weightage

The weight of each stock in the index is based on free-float market capitalization. Therefore, stock selection is based on Nifty 50 weightage. We usually analyze stocks based on their weightage in the Nifty 50. Although, this method was helpful for the investors to build their portfolio.

Technical Analysis for Trade Setups

The use of price action, moving averages, RSI, MACD, Bollinger bands, and trend analysis is employed to identify potential breakout levels. Additionally, using various tools helps traders identify stock trends, identify entry and exit points, and gain insight into stock price fluctuations.

Global Market Influence & Key International Events

We monitor global markets like Asia, Europe, and the U.S. to anticipate changes in market sentiment that could impact Nifty. Therefore, an increase in U.S. interest rates could significantly impact both Indian and global markets. Global sentiments affect Nifty Trading Tips specifically.

Domestic Market News & Sector Trends

Tracking includes news related to sectors, economic policies moving the Nifty for traders. Following these tracked is again beneficial to evaluate which sectors are performing or not. Also traders often watch how money is shifting from one sector to another which affects Nifty Direction.

Fundamental Stock Analysis for Strength & Valuation

Fundamental analysis comprises financial soundness, earnings, sector strength, and determining the direction of the markets. In addition to technical analysis, fundamental analysis allows us to find trustworthy companies at better price points.

Option Chain & Open Interest Analysis

The team analyzes Nifty option chain, open interest, PCR, IV to assess market, providing traders with support and resistance levels for bullish, bearish sentiment. The market is indicating a directionally upward trend due to the significant volume at specific strike prices.

Volatility & Risk Factor Assessment

In regards to risk, pinpoint the important derivative indicators needed to assess market risk, VIX, and expected volatility in India. We manage risk more efficiently depending on the state of the market. High signals are uncertain, while low IV signals are stable

Multi-Factor Correlation for Market Sentiment

Our experts typically combine technical, fundamental, global, and derivative indicators to predict the price direction instead of relying on one indicator only. Open interest trends, along with price movements, indicate the belief behind bullish or bearish trade set ups.

Probability-Driven Trade Selection

This type of trade selection uses historical patterns and statistical models to determine the probability of potential market outcomes prior to making the trade. As trades that exhibit high. By combaining technical analysis with option improves precision in directional strategies.

Final Trade Execution with Well-Defined Entry & Exit

We generate the final Nifty option trade with specific entry, target, stop-loss strategies after integrating all observations. We guide traders where to enter, what target to aim for, where to exit if things don’t go as planned (stop-loss). It ensures discipline, clarity, and risk control.

Get a Detailed PDF on Nifty Trading Strategy!

Fill out the form below to receive it directly on WhatsApp.

Exclusive Benefits of Our Nifty Trading Services

Our structured approach ensures accuracy, efficiency, and a hassle-free trading experience. Here’s why traders trust us

Why Our Nifty Option Tips Stand Out?

Deep Market Research & Analysis

This analysis helps to make informed decisions that can enhance profits and lower the risk. Our research helps to find the overall market size, growth rates. It studies the ground-level data and the various factors influencing the market conditions.

Smart Trading for Smart Profits

Smart trading helps traders to reduce their losses using different strategies. It focuses on risk management and also to take data driven decisions to maximize returns.

Direct Telephonic Assistance

We provide support over the calls and our experts will clarify doubts to refine your trading strategies. And also we educate clients about the market movements.

Seamless Trading Experience

Whether you are a beginner or an experienced trader it gives hassle free experience to execute trades and to manage investments.

Instant Whatsapp Updates

Get key market news and trade alerts in real-time, ensuring you never miss an opportunity.

SEBI-Registered Investment Advisor

As a SEBI registered advisor we advise clients how to invest in stocks. We assess the client’s risk appetite and we give recommendations accordingly.

Free Portfolio Health Check-Up

Free assessment helps to analyze a client’s portfolio to identify their strengths and weaknesses which aligns with their financial goals.

Saves Your Research Time

Skip the hassle of analyzing market trends—our ready-to-use trade setups save you hours of market research.

What We’re Providing to Our Customers ?

Every trader is different, has different needs, and has varying capital. Therefore, to fulfill every trader’s needs, we have designed 3 different service packages for Nifty and Bank Nifty tips. Whether you’re a beginner or an advanced trader, our tips are designed to fit the trading style of every trader. We send you easy-to-follow tips via WhatsApp to help you trade smartly and effectively.

Our Nifty Option Trading Packages

We provide precision-based equity market tips

intraday with well-managed risk and research-driven execution.

Beginner's Boost

- Suitable for beginners with small capital.

- 1 Intraday Trade per Day

- 22 Trading Sessions

- 40 Points (Target stop-loss)

- Market Segments (Bank Nifty)

- Daily Market Updates

- WhatsApp Updates

Growth Wave

Suitable for moderate traders with decent capital

- 1 Intraday Trade per Day

- 22 Trading Sessions

- 60 Points (Target stop-loss)

- Market Segments (Nifty & Bank Nifty)

- Daily Market Updates

- WhatsApp Updates

- Relationship Manager

Wealth Amplifier

Suitable for Experience Traders with Good capital

- 1-2 Intraday Trades per Day

- 30 Trade Sessions

- 80-100 Points (Trailing SL Strategy)

- Market Segments (Nifty & Bank Nifty)

- Daily Market Updates

- WhatsApp Updates

- Relationship Manager

- Direct access with Researcher

- Research Reports

- Informed Decision Making

Let a SEBI-registered investment Advisor Assist you In your trading Journey.

Request a Quote

Maximizing Returns With Our Expert Nifty Option Tips

We support live intraday trading with our expert Nifty option tips, which we have designed to support day traders by offering them in-depth analysis and the latest updates about international market news, domestic market updates, and deep technical analysis. We aim to help you make the most out of the market by guiding you in making the right decision. So, we provide you with wholly framed recommendations. We are additionally following up with complete updates to keep you well-informed about the trade. We provide trades based on detailed analysis. Our goal is to assist you by providing a complete, deep analysis that guides you to trade with confidence. If you wish to read about our intraday trading tips, click the button below

Our Research & Analysis Approach

At The Trade Bond, our research and analysis approach is designed to give our traders the most out of the market. Trading in Nifty Options is mainly affected by international market sentiments, domestic market news, the overall performance of Nifty fifty stocks, as well as volatility and volume at a particular strike price. That is why at The Trade Bond, we focus on overall research by concentrating on each sentiment that has a significant potential to affect the cost of the premium of Nifty options.

Trusted and Certified: SEBI Registered & BASL Certified

We feel proud to say that we are SEBI-registered and BASL-certified investment advisors. Our commitment to compliance and ethical practice means you can trust us. As a SEBI-registered investment advisor, we try to meet the highest standards of professionalism. With The Trade Bond, you’re not just trading—you’re trading with confidence, backed by regulatory approval.

Let’s Talk! Choose a Video or Audio Call & Get Expert Guidance!

Frequently Asked Questions

Why to trade Nifty Options Tips instead of Nifty Futures?

Because of the low premium with a minimum investment, we can trade minimum capital with a low premium price. Nifty Options Tips have limited risk, provide flexibility, and require low capital compared to Nifty Futures. Although traders can trade minimum capital with a low premium price, Nifty Options Trading offers more flexibility through various strategies.

How to select strike prices for Nifty Options Trading?

Nifty Options Trading strike price selection depends on the timeframe, market conditions, and volatility. Choosing moving price ranges in nifty options helps traders gain profits.

What factors affect Nifty Options prices?

Factors that affect Nifty Option prices are:

- Nifty Index Price – This factor affects when the call or put options rise and fall.

- Expiration of Time – High premiums have a longer expiration time than low premiums.

- Price demand – when the price is high for a particular option, there is a chance of a rise; likewise, if the price is low for the option, it will fall.

What are the best indicators for Nifty Option Intraday tips?

The best indicators for Nifty Option Intraday trading tips are:

- EMA – Exponential Moving Average is best in balancing profitability for delivering overall returns.

- MCAD – The Moving Average Convergence Divergence indicator is one of the best technical indicators because it helps spot potential buy/sell signals.

- RSI – It helps to measure the speed and change of price movements in the market.

When should you avoid the Nifty Options?

When global markets have unfavorable news, the Nifty moves in a range or generates no volume. Avoid Nifty Option trading when the market experiences price fluctuations. As a new trader, trading Nifty options is complex and requires a good understanding of price, strategies, and risk management.

How does the Nifty Option work?

Nifty Options are contracts where traders can buy/sell the stocks on a particular date. Traders can also speculate on future price movements in Nifty options trading.

What should I look for in a reliable Nifty Option Tips provider?

A reliable Nifty Tips provider should be SEBI registered. Usually, SEBI-registered tips providers offer real-time tips with proper stop-loss. They suggest trades according to your capital. They also provide risk management guidance for entry and exit strategies.

How can I get started with receiving Nifty Option Positional Tips from your service?

Enroll your profile by filling out the risk profile form. Half of that will be your suitability after you sign an engagement letter. After completing your KYC, you can pay and get an invoice for your service, and your service will start.

How do your Nifty tips help to gain maximum returns?

There is no sure short-term return or guaranteed return in the market. Add to that the genuine way we focus on market factors like technical and fundamental analysis. On behalf of that, we maximize your return because the market is subject to risk.

What strategies help traders in Nifty Option Tips?

The Nifty Options Trading Strategies help traders are:

- Bifurcate your investment in equal parts.

- Avoid over-trading.

- Trade with proper stop-loss and entry points.

- Don’t invest in single trades.

- Don’t be greedy in the market.

- Trailing stop-loss strategies.