Long-Term Stocks for Investment | Wealth-Building Advisory

Reliable Long-Term Stocks for Wealth Growth & Stability

Finding shares for long-term investment will be challenging. Choosing the right stocks can generate consistent returns and secure financial freedom. Our expert research analysis helps to explore long-term stocks.

Why Invest in Long-Term Stocks?

Steady Wealth Accumulation

Benefit from compounding returns over time.

Reduced Market Volatility

Long-term investments smooth out short-term fluctuations.

Financial Security & Growth

Build a robust portfolio for future stability.

Smart Portfolio Building Using Long-Term Stocks for Investment

Investing in long-term stocks helps to build a strong, modified portfolio designed to deliver consistent returns over time.

A well-constructed long-term investment portfolio helps to achieve your financial goals. For example, retirement planning, wealth creation, and securing the family’s future. However, choosing the right stock and managing risk requires professional guidance.

The Trade Bond helps traders and investors to build strong portfolios by recommending the best stocks for long-term investment. We provide long-term stocks based on deep research, risk profile, and capital allocation strategy. Whether you’re starting from scratch or already holding the long-term positions. Our insights help investors to refine and rebalance their portfolios for better growth and stability.

Key Considerations:

Business Model: Understanding the company’s earnings, financial status…etc.

Check financial health: Check for the debt levels, profits, and earnings consistency.

Future-focused companies: Look for the future-focused companies that are aligned with healthcare innovation and renewable energy.

Comparing Stock Price: Do valuation by comparing stock price to its intrinsic value using different tools like P/E ratio and P/B ratio.

Worried about your current portfolio?

Get a FREE Portfolio Health Check-Up with our advisory team.

We’ll review your holdings, spot red flags, and suggest improvements — completely free of charge.

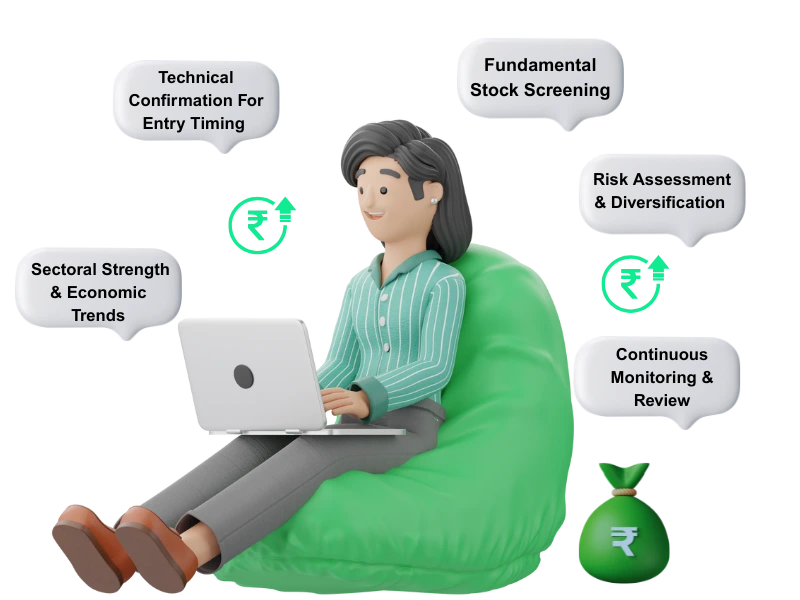

How We Select the Best Long-Term Stocks for Your Portfolio?

At The Trade Bond, our recommendations for long-term stocks are based on speculation. They’re the result of a structured, multi-layered research process that blends fundamental and technical sectoral analysis.

We follow a professional approach to identify the best long-term stocks for your portfolio:

Sectoral Strength & Economic Trends

We will identify industries that are expected to benefit the economy with long-term structural changes. This also ensures that our stock picks are positioned in segments. Also, that offer consistent demand, government support, and future scalability.

Technical Confirmation For Entry Timing

Even in long-term investing, timing your entry can improve returns. We apply technical indicators like moving averages, support zones, and volume analysis to confirm the right buying range. It will help to minimize the risk during a short-term peak or weak market phase.

Fundamental Stock Screening

After we shortlist the sectors, we evaluate companies based on their financial performance. The trade bond looks for stable revenue growth, strong profitability ratios, manageable debt, and a competitive edge in the market.

Risk Assessment & Diversification

No portfolio should rely too heavily on one stock or theme. Before giving a recommendation, we analyze your portfolio exposure, asset allocation, and risk appetite. Also, we help to ensure every addition enhances support for your long-term financial goals.

Continuous Monitoring & Review

Our research helps to find the market conditions, earnings reports, and global trends that evolve in the market. We regularly review stocks performance; also, we monitor news flow and stay alert for red flags. If it requires, we update or rebalance your portfolio to protect your investment journey.

Beginner's Boost

Suitable for investors with capital between ₹2 – ₹5 Lakhs

- Basic Risk Profile Analysis

- Standard Investment Planning

10–15 Stock Recommendations

Investment Horizon: 3 Years

Portfolio Review: Twice a Year

Market Segments: Multi-sectoral

Daily Market Updates

WhatsApp Support

Approx. 15% Upside / 15% Downside

Growth Wave

Suitable for investors with capital ₹5 – ₹10 Lakhs

Detailed Risk Profile Analysis

Sector-wise Investment Planning

15–20 Stock Recommendations

Investment Horizon: 3–5 Years

Portfolio Review: Quarterly

Market Segments: Multi-sectoral

Daily Market Updates

WhatsApp Support

Relationship Manager Support

Approx. 20% Upside / 15% Downside

Wealth Amplifier

Suitable for investors with capital above ₹10 Lakhs

Comprehensive Risk Profile Analysis

Personalized Investment Strategy

20–25 Premium Stock Recommendations

Investment Horizon: 3–5 Years (Growth Focused)

Portfolio Review: Monthly + On-demand

Market Segments: Diversified across sectors

Daily Market Updates

WhatsApp Support

Relationship Manager (Priority Access)

Direct Access to Research Desk

Detailed Research Reports

Informed Decision-Making Guidance

Approx. 20–30% Upside / 15–20% Downside

How to start long-term investing in stocks

To start long-term investments in stocks, you don’t require large capital. It requires clarity and discipline. Here is the step-by-step approach:

Define Your Investment Goals: Goals such as retirement planning, wealth creation, or education-related goals.

Do proper research: Search for the companies using financial statements, analyzing company earning reports.

Monitor regularly: Shortlist 10-20 companies and monitor them regularly over a period of time.

Invest to save money: Invest in mutual funds and SIPs to save money.

Review Regularly: Review the company’s performance regularly and stay updated with trends.

To understand how long-term investing can identify potential penny stocks. Explore our detailed guide to learn how penny stocks work and why they attract retail investors.

Common mistakes to avoid in long-term investment

Understanding business fundamentals instead of chasing trends.

Lack of patience during market downturns.

Overexposure to a single stock or sector by ignoring the portfolio.

Not tracking corporate governance or regulatory issues.

Advantages of Long-term Investments

Long-term investing helps to build wealth steadily over the years. Here are some meaningful advantages in the long-term investment:

1. Investment Grow

When investments grow, investors generate their own returns, and this will create exponential growth over time. The longer the holding period, the more significant the compounding effect.

2. Movements Influenced By

Short-term market movements are often influenced by the news, sentiment, and volatility. Long-term investing allows you to ignore temporary fluctuations and focus on the business fundamentals instead.

3. Lower Transaction Costs

Long-term investors can have lower brokerage charges, taxes, and slippages when compared to active traders with fewer trades. This helps retain a greater share in overall gains.

4. Consistence Performance

Companies with consistent performance often divide their profits as dividends. This may become a reliable source of passive income for investors who hold quality stocks.

5. Portfolio Management

Long-term investing doesn’t need continuous monitoring. It helps investors to adjust their holdings periodically rather than reacting to daily swings.

6. Tax Benefits

Long-term holdings may be taxed at a lower rate than short-term trades. Encouraging longer holding periods and better planning.

7. Long-term Goals

Long-term investments can be mapped to long-term goals such as retirement and children’s education. This approach promotes disciplined saving and investing over time.

Let a SEBI-registered investment Advisor Assist you In your trading Journey.

Request a Quote

Why You Can Rely on The Trade Bond for Long-Term Wealth Creation

At The Trade Bond, we don’t just give stock names—we offer an advisory-driven approach to your wealth creation. As a SEBI-registered investment advisor, we offer strict research protocols, compliance norms, and ethical standards. Also, we focus on:

Risk-managed investment

Transparent communication

Wealth-building strategies

With years of experience in guiding retail investors, our goal is simple: to help you build a reliable portfolio that supports your financial future.

Also, if you wish to read about our Nifty Option tips please click the below button

How The Trade Bond helps to design your Long-term portfolio

Designing a long-term investment portfolio involves aligning your goals, risk appetite, and time horizon with proper decision-making. Here how The Trade Bond helps in your journey.

1. Understanding Your Financial Goals

We know about your long-term goals, whether it’s retirement planning, creation of wealth, or increasing your capital.

2. Risk Assessment & Profile Matching

Every investor has their own level of risk. Through a guided process, your risk appetite is assessed so that your portfolio reflects your comfort zone.

3. Asset Allocation Planning

At The Trade Bond we assist your investment mix across various sectors rather than depending on equity stocks. This might include:

Stability over large-cap stocks.

Sector-based stocks for growth

Dividend-paying stocks for regular cash flow

4. Identifying Long-Term Stock Opportunities

We analyze research-backed frameworks:

Financial performance and balance sheets

Industry positioning

Management quality

Historical returns and future potential

This will help in shortlisting companies with the ability to grow steadily.

5. Monitoring and Periodic Rebalancing

The Trade Bond helps to track your portfolio performance and make adjustments that align with your goals.

6. Investor Education & Transparency

We educate investors on how a sector is performing and why a stock is added. This process is collaborative and transparent with regular updates with insights. Also, we inform our investors when there’s a sudden volatility.

7. Goal-Linked Strategy

As a SEBI-registered advisory, we map your life events and milestones. For example:

Children’s education – 15-year investment horizon

Retirement planning – 25+ years

Passive income after 10 years—by doing SIPs

Let’s Talk! Choose a Video or Audio Call & Get Expert Guidance!

FREQUENTLY ASKED QUESTIONS

Why should i invest in Long-term stocks?

Long-term stock investing offers wealth building by allowing your investments to grow over time. It will reduce the impact of short-term market fluctuations. Also, it creates opportunities for the company’s growth. Our researchers help identify potential long-term stocks based on in-depth research analysis. This helps investors to make informed decisions.

Investing in long-term stocks is safe?

Every investment has some level of risk. But long-term offers more stability when compared to short-term. Our experts will guide you towards the companies that have sound fundamentals and sustainable business models. We provide a simplified research and selection process so investors can invest more confidently with less stress.

How to select right long-term stock?

Choosing long-term stocks involves analyzing a company’s financial, growth potential, and management quality. Our researchers work with a structured approach using historical data and data-driven insights. If you’re wondering where to begin, we help you to shortlist the stocks that are aligned with your goals.

What sectors are the best for long term investment?

Sectors with technical advancement, consistent demand, and strong support often show long potential. Our experts can help you to explore sectors that match your investment profile, depending on your risk appetite.

Is stock investment good for long-term trading?

Yes, stock investing is good for the long term because they offer consistency by allowing fixed investments. Traders can invest in individual stocks in a systematic way, which is highly beneficial.

How does Bank Nifty effects long-term trading?

Yes, Bank Nifty plays a significant role in long-term trading. It offers more market volatility when compared to the Nifty 50.

How long i can hold long term stock?

For the long-term duration, there’s no fixed duration. Traders can hold for 5 to 10 years to grow their business and to get returns. Our researchers review your portfolio and share insights that help you to decide whether to hold or rebalance the stocks. The holding period is flexible based on your financial needs.

How the Trade bond helps beginners to invest in long term stocks?

Our advisor guides you from the basic understanding of stock selection using simple, actionable strategies. The Trade Bond focuses on building your confidence, which helps traders to make informed decisions.

How we help to build your portfolio?

At The Trade Bond, we focus on understanding your financial goals, risk comfort, and time. Also, we support traders with regular updates and portfolio reviews whenever needed.

Why to rely on The Trade Bond for wealth creation?

The Trade Bond will support you with the right knowledge and curated ideas on stocks. Our expert team provides access to insights that aim to equip your investment with long-term success. We believe that wealth creation is a journey that requires discipline and patience.

How can option trading used to protect long-term stock investments?

Using put options will act as insurance and limit losses if the stock price falls.