The Trade Bond in the News: Market Perspectives

At The Trade Bond, our commitment towards research-based insights and transparent market analysis has earned recognition among media platforms such as MSN, Asianet News, CNBC 18, and Inshorts. These features reflect our growing influence in simplifying difficult market movements and sharing practical perspectives on various segments. In segments like Bank Nifty, Nifty, and stock market trends. Also, being featured by reputed media highlights the trust our work inspires within the trading community. Through education blogs, we educate traders with clarity, awareness, and strategic understanding. To make financial knowledge accessible and relevant for everyone navigating India’s dynamic market landscape.

Our Insights Highlighted by CNBC News 18

The Trade Bond’s Insights Featured by MSN

Vedanta Outbids Adani For Jaiprakash Associates

The Trade Bond’s perspective on India’s corporate acquisition landscape was recently featured on MSN in an article titled “Vedanta Outbids Adani For Jaiprakash Associates—Diversification Push Raises Concerns.” The feature highlights how Vedanta’s aggressive diversification strategy signals a shifting phase in India’s infrastructure and resources sector while raising questions about long-term debt sustainability and sectoral focus.

Our contribution reflects on market reactions and what such moves indicate for investors tracking conglomerate-led expansions.

Tata Motors, Mahindra, Hyundai, And Renault Cut Car Prices After GST Overhaul

The Trade Bond’s insights on India’s auto sector and market sentiment were recently featured on MSN in an article titled Tata Motors, Mahindra, Hyundai, And Renault Cut Car Prices After GST Overhaul.” The feature discusses how the GST revision has prompted leading automakers to reduce prices, potentially driving short-term demand and reshaping the competitive landscape.

Our commentary focuses on the broader economic impact of tax reforms and their influence on investor confidence within the automobile sector.

Infosys To Mull Buy back Will Board Nod Push Stock Past ₹1,450 Resistance?

The Trade Bond’s market perspective was recently featured on MSN in the article titled Infosys To Mull Buy back Will Board Nod Push Stock Past ₹1,450 Resistance. The coverage highlights Infosys’ consideration of a share buyback program, signaling management’s confidence in long-term growth and balance sheet strength.

Our analysis focuses on how such corporate actions can influence investor sentiment, liquidity, and valuation metrics within the IT sector. This development also reflects broader market optimism surrounding India’s technology majors.

EU Export Approval Sparks Rally In Avanti Feeds, Apex Frozen Foods, Coastal Corporation

The Trade Bond’s commentary on sectoral market movements was recently featured on MSN in an article titled “EU Export Approval Sparks Rally In Avanti Feeds, Apex Frozen Foods, Coastal Corporation.” The coverage highlights how the European Union’s export approval boosted investor confidence in India’s seafood exporters, leading to a notable rally across select mid-cap counters.

Our insights focused on how regulatory developments and trade permissions can influence short-term market sentiment and long-term growth potential within the export sector.

Dr Reddy’s Expands Portfolio With Stugeron Buy

The Trade Bond’s insights on pharmaceutical sector trends were recently featured on MSN in an article titled “Dr Reddy’s Expands Portfolio With Stugeron Buy—SEBI Analysts Flag Cost Risks But See Medium-Term Gains.” The coverage explores Dr Reddy’s strategic acquisition aimed at strengthening its therapeutic portfolio, while analysts weigh potential cost challenges against growth opportunities.

Our perspective highlights how acquisitions of this nature influence valuation outlooks, sector competitiveness, and investor sentiment in the healthcare space.

Nifty Opens Below 25,100; IT, Pharma Weigh While Rail, Defense Stocks Shine

The Trade Bond’s early market commentary was recently featured on MSN in an article titled “Nifty Opens Below 25,100; IT, Pharma Weigh While Rail, Defense Stocks Shine.” The coverage highlights sectoral rotation in the Indian markets as weakness in IT and pharma balanced gains in rail and defense counters.

Our analysis focuses on how traders can interpret such mixed-sector trends to identify short-term opportunities within broader index movements.

Other Important links of MSN

Asianet News Highlights The Trade Bond’s Market Outlook

Maruti, M&M, Hero Moto, Tata Among SEBI Analyst’s Top Picks As Lower GST Comes Into Effect

Maruti Suzuki, Mahindra & Mahindra, Hero MotoCorp, and Tata Motors gained traction as SEBI analysts listed them among top picks following the GST rate revision on vehicles. While initial reactions were mixed, traders on asianet news highlighted renewed optimism across the auto sector, as lower taxes could stimulate consumer demand ahead of the festive season.

The Trade Bond’s post on Asianet news examines how this GST cut may reshape the auto industry’s pricing dynamics and drive long-term volume growth for leading manufacturers. Read the full post as shared on Asianet here: Maruti, M&M, Hero Moto, Tata Among SEBI Analyst’s Top Picks As Lower GST Comes Into Effect

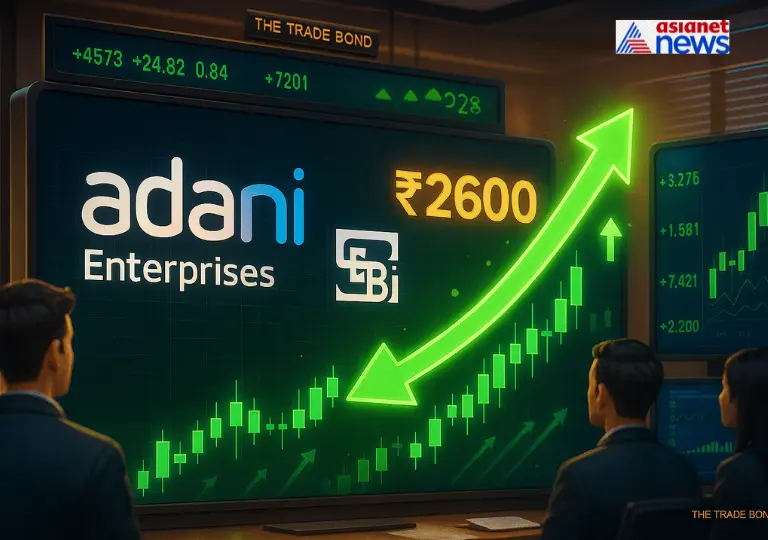

Adani Enterprises, Ports, Power Shares Surge After SEBI Dismisses Manipulation Charges

Adani Enterprises, Adani Ports, and Adani Power shares rallied sharply after SEBI dismissed market manipulation allegations, bringing relief to investors. The verdict restored confidence in the Adani Group’s transparency and governance, sparking renewed buying interest across the conglomerate’s listed entities.

The Trade Bond’s post on Asianet highlights how this clean chit could shift sentiment toward infrastructure and energy stocks while improving FII inflows into the broader market. Read the full post as shared on Asianet News here: Adani Enterprises, Ports, Power Shares Surge After SEBI Dismisses Manipulation Charges

Adani Group Gets Clean Chit From SEBI – RIA Sees Sharp Relief Rally, Flags ₹2,600 Target For Adani Enterprises

Adani Group stocks surged after SEBI cleared the conglomerate of manipulation allegations, sparking a sharp relief rally across key entities. Market sentiment turned positive as investors regained confidence in Adani Enterprises’ fundamentals and governance.

SEBI-registered advisors noted that the clean chit could drive a sustained uptrend in Adani Enterprises, with technical analysts flagging a near-term target around ₹2,600. The momentum also lifted Adani Ports and Adani Power, signaling renewed institutional interest in infrastructure and energy counters. Read the full update as featured on Asianet News here: Adani Group Gets Clean Chit From SEBI

Indian Markets Open Firm On Expiry Day; Auto, Metals, Energy Lead Gains

Indian equities opened on a firm note on expiry day, supported by strong buying in auto, metal, and energy sectors. The Nifty traded comfortably above the 25,200 mark in early deals, while the Sensex held steady amid positive global cues, stable crude oil prices, and a broadly supportive market environment.

Auto stocks such as Maruti Suzuki and Tata Motors led the rally as traders factored in the benefits from the recent GST rate adjustments and festive season demand expectations. Meanwhile, metal and energy counters also gained momentum on hopes of robust quarterly earnings and an improved industrial demand outlook. Read the full update as featured on Asianet News here: Indian Markets Open Firm On Expiry Day; Auto, Metals, Energy Lead Gains

Weak Start On Dalal Street, Nifty Slips Below 25,200; Auto Stocks Buck The Trend

Indian markets opened on a cautious note as Nifty slipped below the 25,200 mark, weighed down by weakness in IT and pharma stocks. Broader sentiment remained subdued amid mixed global cues and rising bond yields.

However, auto stocks bucked the trend, with Maruti Suzuki and Tata Motors showing resilience on expectations of festive season demand. Analysts suggest that a close above 25,250 could restore bullish momentum, while support remains near the 25,000 level. Read the full update as featured on Asianet News here: Weak Start On Dalal Street, Nifty Slips Below 25,200; Auto Stocks Buck The Trend

Tata Motors In Sell Zone As JLR Cyberattack Puts £2 Billion Loss On The Table

Tata Motors shares faced selling pressure after reports emerged of a major cyberattack on Jaguar Land Rover (JLR), potentially leading to a £2 billion loss. The news triggered caution among investors, with analysts advising restraint until clarity emerges on the financial and operational impact.

While the company’s long-term fundamentals remain steady, short-term sentiment has turned weak. SEBI-registered advisors noted that traders should monitor support levels closely before re-entering. Read the full update as featured on Asianet News here: Tata Motors In Sell Zone As JLR Cyberattack Puts £2 Billion Loss On The Table

Other Important Media Links on Asianet News

The Trade Bond’s Voice on Stocktwits: Tracking Market Trends

At The Trade Bond, we offer transparent and insightful market discussions. Our presence on stocktwits shows our commitment towards connecting with an active community of traders. And also to connect with the investors and market learners as well. Therefore, with our timely updates and research-based observations, we share perspectives on Nifty, Bank Nifty, and sectoral trends that are shaping India’s financial landscape.

By engaging on stocktwits, The Trade Bond aims to simplify complex market movements and encourage conversations among retail investors. Our motto is to promote disciplined trading and strengthen awareness through market insights that add more value to the trading community.

NTPC Green Gains After Gujarat Solar Deal, SEBI Advisor Sees Over 40% Upside Potential

NTPC Green Energy shares gained traction after signing a significant solar power development deal in Gujarat, strengthening its renewable portfolio. SEBI-registered analysts highlighted the company’s expanding clean energy footprint and projected a potential 40% upside in the medium term.

The Trade Bond’s post on Stocktwits explains about how this strategic move aligns with India’s renewable energy goals and positions NTPC Green for sustained investor interest. Read about the full article as shared on Stocktwits here: NTPC Green Gains After Gujarat Solar Deal, SEBI Advisor Sees Over 40% Upside Potential

Mankind Pharma Strengthens Specialty Segment With ₹797 Crore BSV Deal

Mankind Pharma has expanded its specialty medicines portfolio through a ₹797 crore acquisition of Bharat Serums and Vaccines (BSV) assets, marking a key step in its long-term growth strategy. SEBI analysts noted that this move enhances Mankind’s position in high-margin therapeutic categories that strengthen its institutional market presence.

Our post on Stocktwits highlights how this acquisition aligns with Mankind Pharma’s focus on innovation and portfolio diversification within India’s evolving pharma sector. Read the full post as shared on Stocktwits here: Mankind Pharma Strengthens Specialty Segment With ₹797 Crore BSV Deal

MapmyIndia Shares Surge On Arattai Integration Buzz; SEBI Analyst Sees Turning Point For Indian Tech

MapmyIndia shares surged amid market buzz around a potential integration with Arattai, a domestic social platform, signaling renewed investor confidence in Indian tech innovation. SEBI analysts suggested this could mark a crucial turning point for MapmyIndia’s growth trajectory, especially in digital mapping and AI-driven mobility solutions.

The Trade Bond’s post on Stocktwits explores how this rumored collaboration reflects the broader momentum in India’s tech ecosystem and what it could mean for sectoral valuations. Read the full post as shared on Stocktwits here: MapmyIndia Shares Surge On Arattai Integration Buzz; SEBI Analyst Sees Turning Point For Indian Tech

Paras Defence Jumps On Israeli Tech Tie-Up — SEBI Analyst Sees Medium-Term Revenue Lift

Paras Defence and Space Technologies’ shares jumped after the company announced a strategic partnership with an Israeli tech firm, aimed at advancing defense electronics and surveillance systems. SEBI analysts noted that this collaboration could boost medium-term revenue visibility and enhance Paras Defence’s global technology footprint.

The Trade Bond’s post on Stocktwits examines how this alliance strengthens India’s defense manufacturing ambitions and why traders are optimistic about sustained order inflows. Read the full post as shared on Stocktwits here: Paras Defence Jumps On Israeli Tech Tie-Up — SEBI Analyst Sees Medium-Term Revenue Lift

Real Estate Stocks Stand Tall As Global Rate Cut Bets Lift Sentiment

Real estate stocks rallied as global rate cut expectations boosted market sentiment, driving healthy investor interest in the sector. Analysts noted that lower borrowing costs could revive housing demand and accelerate project launches across major cities.

Our post on Stocktwits discusses how this macro shift may support the real estate sector’s recovery cycle and attract long-term institutional participation, particularly in commercial & residential assets. Read the full post on Stocktwits here: Real Estate Stocks Stand Tall As Global Rate Cut Bets Lift Sentiment

Nifty Opens Firm Above 25,250 Ahead Of Expiry; HCL Tech, RBL Bank Among Top Movers.

Nifty opened firm above the 25,250 mark ahead of the expiry session, supported by strong buying in IT and banking counters. HCL Tech and RBL Bank emerged among the top gainers as traders positioned for short covering and sector rotation.

Our The Trade Bond’s post on Stocktwits highlights how expiry volatility shaped intraday sentiment and what technical levels traders are watching for potential momentum continuation in the next session. Check out the full article as shared on Stocktwits here: Nifty Opens Firm Above 25,250 Ahead Of Expiry; HCL Tech, RBL Bank Among Top Movers