Stock Picks for Today’s Intraday Trade – 28th November, 2025

Overview of Intraday Stock Picks

Intraday trading can be lucrative if backed by appropriate research and timing. October , 2025, presents many trading opportunities based on early market trends, technical analysis, and global cues. This blog outlines some chosen stocks for intraday traders to follow with associated levels, indicators, and trading strategies.

Top Intraday Stock Picks: Best Stocks for Intraday Trading Today You Should Watch

1. Sun Pharma

• Revenue: Up 8% YoY at ₹14,478 Cr

• Gross Profit: Up 14% YoY at ₹3,798 Cr

• Net Profit: Up 3% YoY at ₹3,137 Cr

2. Grasim: Strong Growth Across Financial Metrics

• Revenue: Up 18% YoY at ₹39,900 Cr

• Gross Profit: Up 38% YoY at ₹2,973 Cr

• Net Profit: Up 41% YoY at ₹1,437 Cr

3. Britannia: Profitability Improves on Better Margins

• Revenue: Up 3% YoY at ₹4,841 Cr

• Gross Profit: Up 22% YoY at ₹869 Cr

• Net Profit: Up 22% YoY at ₹658 Cr

4. Britannia: Profitability Improves on Better Margins

• Revenue: Up 3% YoY at ₹4,841 Cr

• Gross Profit: Up 22% YoY at ₹869 Cr

• Net Profit: Up 22% YoY at ₹658 Cr

5. Aurobindo Pharma: Stable Growth Momentum

• Revenue: Up 6% YoY at ₹8,286 Cr

• Gross Profit: Up 5% YoY at ₹1,249 Cr

• Net Profit: Up 3% YoY at ₹846 Cr

6. Redington: Healthy Growth Across Metrics

• Revenue: Up 16% YoY at ₹29,076 Cr

• Gross Profit: Up 30% YoY at ₹533 Cr

• Net Profit: Up 23% YoY at ₹350 Cr

7. Tube Investments: Moderate Growth with Steady Margins

• Revenue: Up 12% YoY at ₹5,523 Cr

• Gross Profit: Up 2% YoY at ₹380 Cr

• Net Profit: Up 1% YoY at ₹302 Cr

8. Blue Star: Gradual Improvement in Profitability

• Revenue: Up 6% YoY at ₹2,422 Cr

• Gross Profit: Up 17% YoY at ₹140 Cr

• Net Profit: Up 4% YoY at ₹100 Cr

9. Astral Ltd: Robust Revenue and Profit Growth

• Revenue: Up 15% YoY at ₹1,577 Cr

• Gross Profit: Up 23% YoY at ₹185 Cr

• Net Profit: Up 23% YoY at ₹135 Cr

10. Delhivery: Strong Turnaround with Profit Growth

• Revenue: Up 17% YoY at ₹2,382 Cr

• Gross Profit: Up 98% YoY at ₹-1 Cr (improvement from loss)

• Net Profit: Up 221% YoY at ₹61 Cr

11. Honeywell Automation: Consistent Profitability

• Revenue: Up 12% YoY at ₹1,149 Cr

• Gross Profit: Up 4% YoY at ₹119 Cr

• Net Profit: Up 4% YoY at ₹120 Cr

12. Ramco Cements: Strong Profit Recovery

• Revenue: Up 9% YoY at ₹2,239 Cr

• Gross Profit: Up 41% YoY at ₹205 Cr

• Net Profit: Up 204% YoY at ₹76 Cr

Stocks in News

Leela Palaces – Acquired a 25% stake in Dubai’s Sofitel The Palm FZE.

TCS – Signed a 5-year deal with SAP to modernise cloud and AI operations.

HDFC Capital & Hero Realty – Set up a ₹1,000 crore platform for mid-income housing.

Rainbow Children’s Hospital – Announcing plans to add 900 beds, with half coming up in the NCR region.

Mahindra Holidays – Plans to open its first luxury Signature Resort in FY27.

Tata Power – Planning a ₹10,000 crore ingots and wafers plant in Odisha.

Jindal Stainless – MD highlights the need for a dedicated stainless steel sector policy.

Oberoi Group – Announced the opening of The Oberoi Rajgarh Palace in Khajuraho.

Biocon – Bengaluru drug manufacturing facility classified as “Voluntary Action Indicated.”

Glenmark – Monroe facility receives USFDA’s “Voluntary Action Indicated” classification.

ICICI Prudential AMC – Secured SEBI approval to launch its IPO, targeting a $12 billion valuation.

Man Infraconstruction – Promoter purchased an additional 60 lakh shares from the open market.

Tata Elxsi – Partnered with Druid Software to strengthen its enterprise 5G ecosystem.

Lemon Tree Hotels – Signed two new properties in Gujarat and Uttarakhand.

Ashiana Housing – Launched a ₹750 crore residential project in Gurugram (Positive).

Sona Comstar – To apply for India’s rare earth scheme; seeking foreign technology partners.

Wipro – Signed a multi-year deal with Odido Netherlands to transform its IT landscape.

TCS (Cloud & GenAI) – Partnered with SAP for a five-year, enterprise-wide cloud and generative AI transformation.

Rainbow Hospitals – Targeting 3,165 beds by FY29, with North India as a key growth driver.

Zydus Lifesciences – Received USFDA tentative approval for Empagliflozin + Linagliptin tablets; signed a $100 mn MoU with an Afghan pharma firm.

Tata Elxsi (xG-Force Lab) – Expanded its enterprise 5G ecosystem through partnership with Druid Software.

Apeejay Surrendra Park Hotels – Expanded presence in Kolkata with the new “Zone by The Park” property.

Quick Takeaways

Chhattisgarh Housing Board launches housing projects worth over ₹2,000 cr

Economy on stable footing to navigate risks, uncertainties: FinMin review

Airtel MD urges users to shift to its Payments Bank amid cyber fraud surge

Tesla aims to roll out new charging network to boost EV adoption in India

Govt to push green fuel farm machinery to boost mechanisation: Agri secy

Bank credit to improve to 11.5-12.5% in FY26, says CareEdge Ratings

No plan to hike vehicles’ price from Jan; won’t undermine GST rate cut initiative: Mahindra

Safran says global supply chain pressures easing as recovery picks up

India REITs poised for Rs 10.8 trillion growth over next four years: JLL

FinMin, RBI working on portal to help citizens claim unclaimed assets: DFS Secy

Tata Realty takes Rs 1,280 cr loan from DBS Bank for Gurugram project

Residential realty bookings growth remains strong, collection efficiency falls

Equirus Group appoints Manish Jain as CEO of Equirus Finance to lead its NBFC operations

GST hit slows FMCG in Q2, but rural India readies a fightback

India FY26 growth momentum to stay firm amid easing inflation, demand revival

Organized sector to drive food services market 60% higher by 2030: report

JP Morgan pegs Nifty target for 2026-end at 30,000 amid rate cuts, tax break

NITI Aayog panel seeks major regulatory overhaul, calls for scrapping licences and permits

Best Stocks for Intraday Trading Today

Intraday trading, also known as day trading, involves buying and selling financial instruments within the same trading day. This style of trading focuses on capitalizing on small price movements in liquid securities, offering opportunities for traders who are looking to benefit from market volatility and short-term trends.

What is Intraday Trading?

Intraday trading means entering and exiting trades on the same day before the market closes. Unlike positional trading, where investments are held for days, weeks, or even months, intraday trades are not carried forward overnight. The goal is to profit from price fluctuations that occur throughout the trading session.

How Intraday Trading Works

Traders analyze price charts, volume trends, technical indicators, and market sentiment to identify entry and exit points.

Key Characteristics of Intraday Trading

High Liquidity: Instruments that are frequently traded allow for easier entry and exit.

Volatility: Price movement is essential for generating returns in a short time frame.

Risk Management: Intraday traders often use stop-loss and target orders to manage risk.

Leverage: Many traders use margin facilities to increase their exposure, although this also increases risk.

Connect with our SEBI-registered investment advisor to know more about intraday trading tips. Our advisor will help you and guide you with all your queries related to the intraday trading and other segments, like Equity intraday tips, as well. Explore more about the stock picks for today’s intraday trade to understand them better.

Key Technical Indicators Supporting the Intraday Trading Today

01.

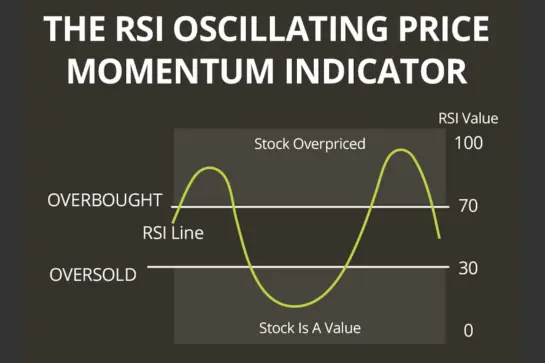

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements on a scale of 0 to 100. Typically, an RSI above 70 indicates overbought conditions, while an RSI below 30 suggests oversold conditions. Traders use RSI to identify potential reversal points and to gauge the strength of a trend.

02.

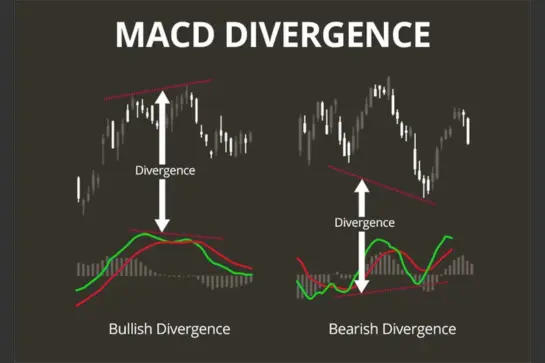

Moving Averages and MACD

Moving averages smooth out price data to identify trends over specific periods. Short-term moving averages, like the 5, 8, and 13-period SMAs, are particularly useful for intraday trading. The MACD, which calculates the difference between short-term and long-term EMAs, helps traders identify trend reversals and momentum shifts.

03.

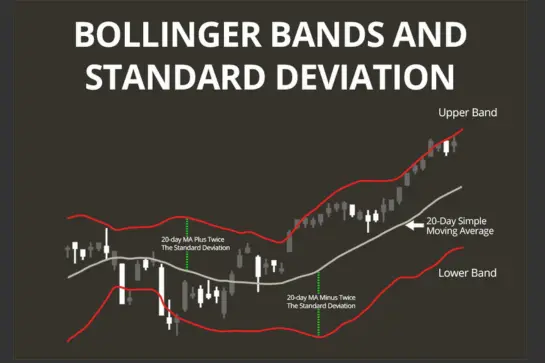

Bollinger Bands

Bollinger Bands consist of a middle band (usually a 20-period SMA) and two outer bands set at standard deviations above and below the middle band. These bands expand and contract based on market volatility. When the price touches the upper band, it may indicate overbought conditions; touching the lower band may suggest oversold conditions.

04.

Average True Range (ATR)

ATR measures market volatility by calculating the average range of price movements over a specified period. A higher ATR indicates increased volatility, which can help traders set appropriate stop-loss levels and position sizes.

Trading Psychology: Navigating Intraday Trading with Confidence

Intraday trading is not just a test of strategy and technical skills — it’s a mental game. The fast-paced nature of the market, rapid decision-making, and the emotional highs and lows can challenge even the most experienced traders. This is where trading psychology becomes a vital tool for success.

Understanding Trading Psychology

Trading psychology refers to the mindset and emotional discipline a trader must maintain while executing trades. It involves controlling fear, greed, hope, and regret — emotions that often cloud judgment and lead to impulsive decisions. In intraday trading, where price action changes within seconds and decisions must be made quickly, the mental game can make or break performance.

Building a Strong Psychological Foundation

Stick to a Trading Plan

A well-defined plan includes your entry, stop-loss, target, and risk-reward ratio. Following it religiously removes emotional decision-making.

Accept Losses as Part of the Game

No trader wins all the time. Managing losses with grace and learning from them builds long-term discipline.

Control Position Sizing

Risking too much on a single trade increases emotional pressure. Using appropriate lot sizes helps stay objective during drawdowns.

Set Realistic Goals

Don’t aim to “beat the market” every day. Focus on consistent performance rather than daily wins.

Use Breaks and Timeouts

Stepping away from the screen after a trade — win or lose — helps reset your mind. Mental clarity often leads to better decisions.

Common Emotional Challenges in Intraday Trading

Fear of Missing Out (FOMO)

Jumping into trades without analysis just because a price is moving rapidly can lead to losses. FOMO causes traders to act impulsively, ignoring strategy.

Revenge Trading

After a loss, some traders rush into new trades to recover quickly. This often leads to even bigger losses.

Overconfidence After a Win

A successful trade can make a trader feel invincible, prompting unnecessary risk-taking. Consistency is a key, not chasing after euphoria.

Paralysis by Analysis

Overthinking or second-guessing strategies can cause missed opportunities. Trusting your preparation and indicators is crucial.

As an intraday trader, facing these emotional challenges can be the biggest challenge. One more thing you all have to keep in mind is that self-learning will be challenging and take a lot of time. So, taking guidance from a SEBI-registered stock market advisor will be more beneficial and can reduce the time of research. Get stock picks for today’s intraday trade from our registered advisors.

Get a Free Health Check-Up for Your Portfolio

If you’re unsure how tariffs affect the stock market or how your portfolio reacts to such macro shocks—it’s time to get clarity.