Stock Market Fall 5 Sept 2025 Gst Reform ITC Impact

Why stock market fall today?

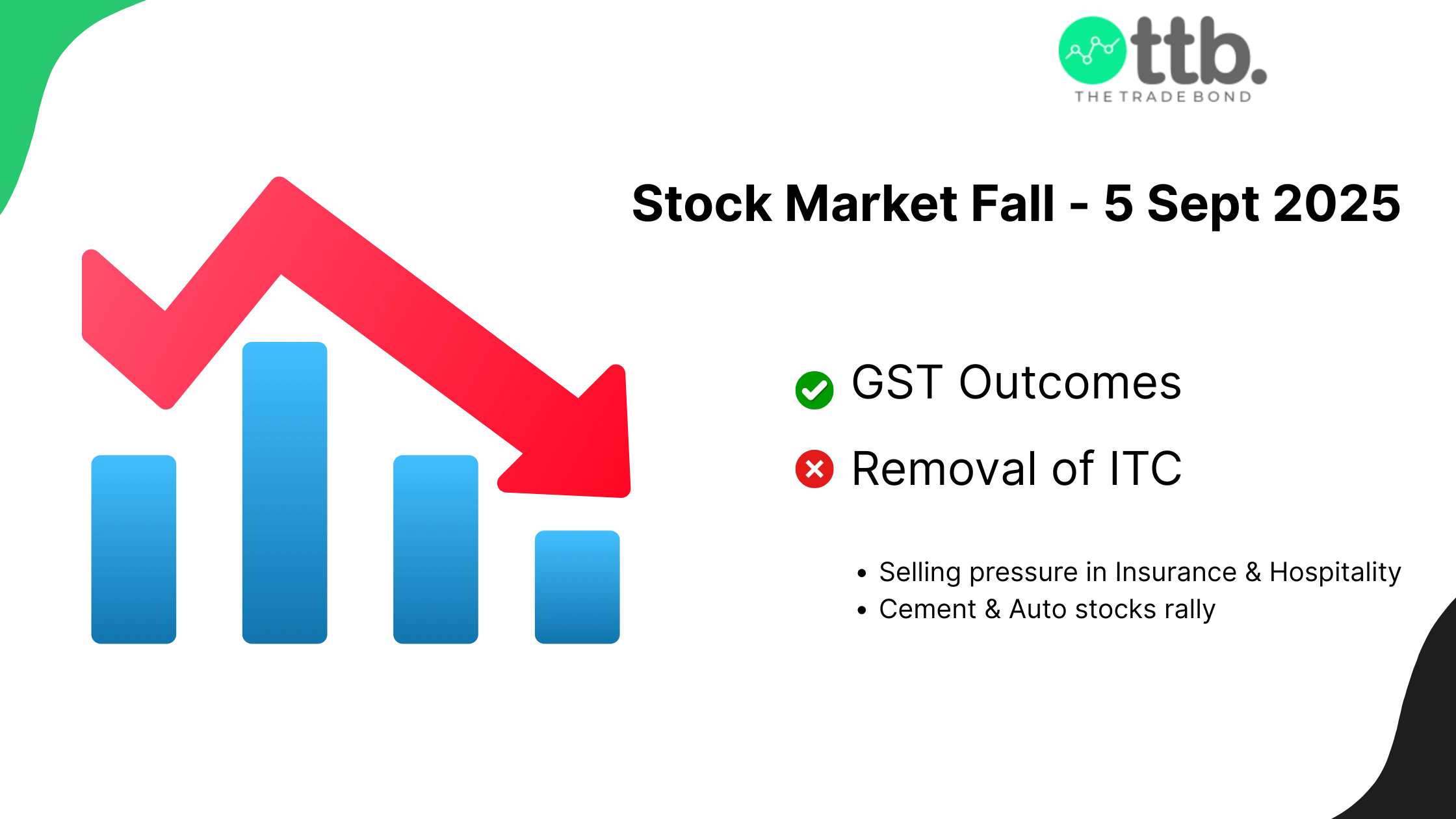

The Indian stock market fall today, 5th september 2025, and witnessed significant selling pressure. Despite the government’s announcement of a major GST reform. On the surface, the reduction of GST on many goods looked positive for businesses and consumers. However, the removal of the Input Tax Credit (ITC) system has shaken investor confidence and triggered a wave of uncertainty across sectors. As a result, benchmark indices slipped into the red, with profit booking visible even in sectors that initially benefited from lower GST rates.

As a share market advisor, we believe today’s market fall is a classic example of how sudden policy shifts can create short-term volatility, even if they are introduced with long-term benefits in mind. Let’s break down the reasons behind the decline and what traders should keep in mind going forward.

GST Reform: What Changed?

The government simplified GST slabs into 5%, 18%, and 40%, while also exempting certain services like life and health insurance. On the positive side, cement, auto, and FMCG companies were expected to gain from lower tax rates. However, the catch lies in the removal of ITC (Input Tax Credit) for these newly exempt or reduced-tax categories.

Without ITC, companies cannot offset the GST they have already paid on raw materials or services. This raises their operating costs, squeezes margins, and creates challenges in passing on benefits to consumers.

For sectors like insurance, hospitality, and financial services, this move is a direct hit. In fact, insurers now face the burden of reversing accumulated ITC on policies sold before the new rules, adding to their financial strain.

Stock Markets Fall Today – Who Won, Who Lost

Insurance & Hospitality: Stocks in these sectors came under pressure as higher costs are expected to dent profitability. Analysts believe insurers may not be able to pass full GST benefits to policyholders.

Cement & Construction: On the flip side, cement stocks such as Ambuja Cements and ACC rallied up to 4% after GST was reduced from 28% to 18%. The infrastructure and housing sectors are expected to see some relief.

Auto & FMCG: These sectors witnessed initial buying but soon cooled down as broader market selling dragged down sentiment.

Overall, while pockets of the market reacted positively, the Nifty and Sensex slipped due to widespread caution and uncertainty.

What Equity Research Analysts Are Saying

From an equity research analyst in India perspective, the key issue is clarity and execution. The reform looks good on paper, but the market hates uncertainty. With ITC gone, balance sheets of several companies will look weaker in the coming quarters. This explains why investors chose to book profits instead of chasing the rally.

Analysts also warn that while sectors like cement may continue to outperform in the short run, service-heavy businesses could see earnings downgrades. Thus, the mixed impact of GST 2.0 is likely to keep the market volatile in the near term.

What Traders Should Do – Expert Insights

For those engaged in intraday trading, today’s session was a reminder that policy-driven moves can change market direction within minutes. The Trade Bond, as an intraday trading tips provider, always emphasizes disciplined stop-loss strategies and sector rotation to manage such risk.

Short-term traders should stay cautious in insurance and hospitality stocks until clarity emerges.

Momentum traders may look at cement and auto stocks for bullish opportunities.

Investors with a medium-term view should wait for further policy details before adding fresh exposure in affected sectors.

As a share market advisor, we also recommend not chasing gaps or sudden rallies. Instead, trade with patience, use strict stop-losses, and keep a close watch on government clarifications around ITC reversals.

Conclusion

The stock market fall on 5th September 2025 due to the removal of ITC, which overshadowed the positive impact of GST cuts. While some sectors cheered the tax relief, the broader market reacted negatively as investors weighed the cost implications for companies.

At The Trade Bond, our team of equity research analysts and intraday trading tips providers continues to monitor these developments closely. We believe such reforms can bring long-term efficiency, but in the short term, they often create volatility and trading opportunities.

For traders and investors alike, the key is to stay informed, adapt strategies quickly, and rely on expert guidance from a trusted share market advisor.

Stay connected with The Trade Bond for real-time updates, market analysis, and actionable intraday trading tips.

FAQ's

Why did the stock market fall today (5th September 2025)?

The stock market fall today mainly because of the government’s GST reform, which reduced tax rates but removed the Input Tax Credit (ITC) system. This raised cost concerns for companies in insurance, hospitality, and financial services, triggering widespread selling.

What should traders do when the stock market falls due to policy changes?

When the stock market falls today because of sudden policy moves, traders should avoid panic trading, use strict stop-losses, and focus on sectors showing strength, such as cement and autos. Short-term investors are better off waiting for clarity before making fresh entries.

Is the fall in the stock market today temporary or long-term?

Equity research analysts believe today’s fall is a short-term reaction to uncertainty around ITC removal. While volatility may continue in the near term, the long-term outlook depends on how companies adjust to the new GST regime and its impact on margins.