Bank Nifty Index Composition and Weightage of Top Banks

Introduction

The weightage of banks in Bank Nifty plays an important role in shaping how this key market index performs daily. Understanding this concept helps you analyze market direction by identifying strong-performing banks. So, you can plan your effective strategies accordingly. Therefore, the Bank Nifty index represents the performance of leading banking stocks listed on the NSE, both from public and private sectors.

Therefore, every bank contributes differently to the index. Hence, knowing their individual weightages helps to estimate how a small price change in major banks like HDFC, ICICI. They can influence the overall movement of the Bank Nifty index. This knowledge is useful for those who follow Bank Nifty tips or those looking to refine their Bank Nifty intraday trading strategies.

The Purpose of the Bank Nifty Index in Indian Markets

The Bank Nifty index acts as a benchmark that reflects the financial strength and sentiment of India’s banking sector. This index includes 12 major banks that reflect the sector’s financial health, investor confidence, and overall market sentiment. Also, the primary purpose of this index is to provide investors with a reliable measure of how these banking stocks are performing.

For traders, it acts as a trading instrument to analyze trends, plan intraday trades, and study sectoral performance. Therefore, SEBI-registered stock market advisor use the Bank Nifty as a key indicator while guiding clients on market behavior.

What Does Weightage Mean in Bank Nifty?

Weightage in Bank Nifty means the amount of contribution by each bank within the index. A higher weightage means that a particular bank has more influence on the index movement.

As an example, if HDFC Bank holds around 25% weightage, a 1% move in its stock price can impact the Bank Nifty. On the other hand, a smaller-weighted bank like IDFC First Bank or Federal Bank will show less effect on the index.

Therefore, understanding these percentages helps traders to predict how Bank Nifty reacts when certain major banks show volatility. So, following a Bank Nifty tips provider or research techniques in intraday Bank Nifty helps to track these numbers regularly.

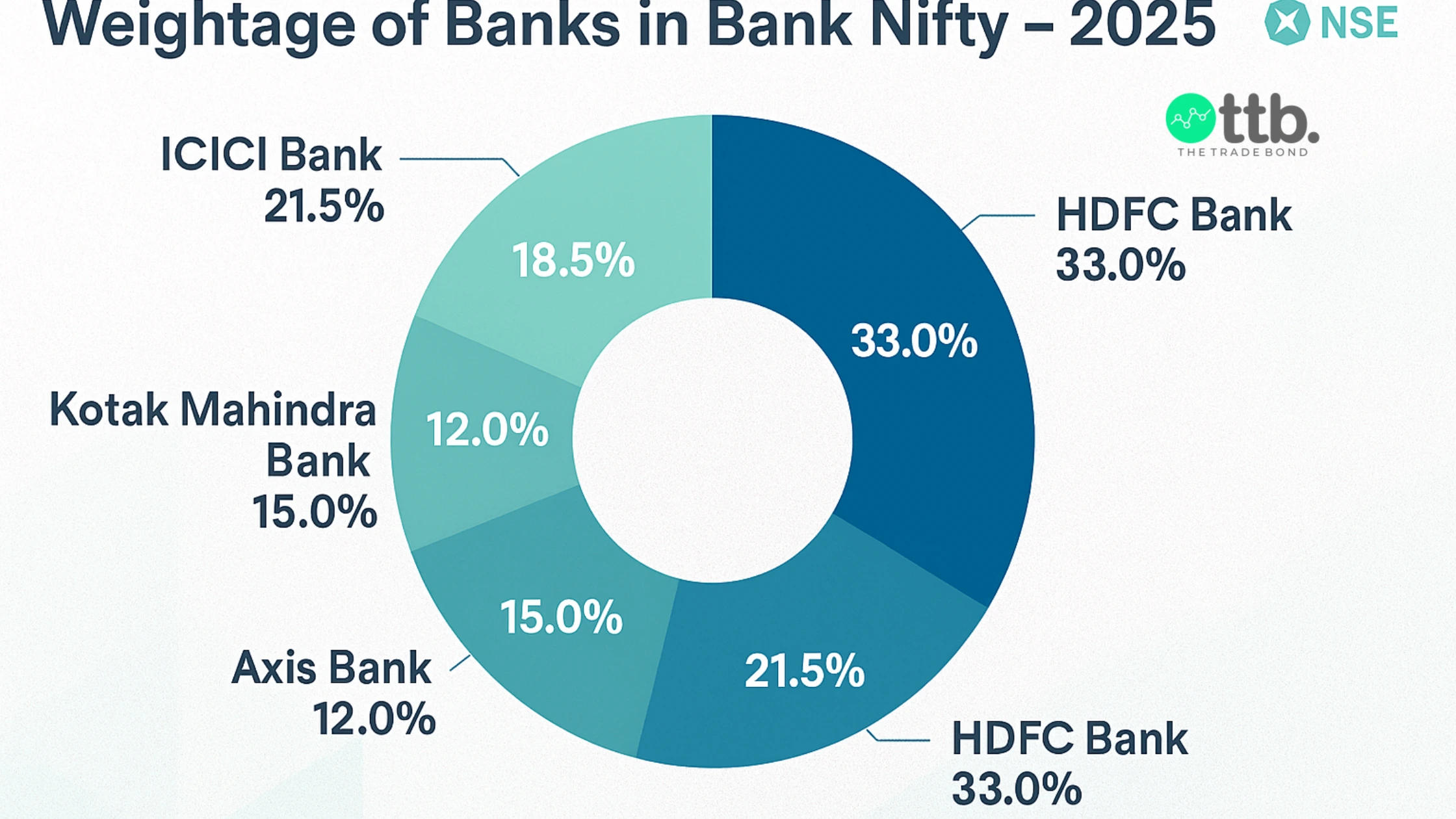

Current Weightage of Banks in Bank Nifty (2025)

As of 2025, the weightage of banks in Bank Nifty is largely dominated by private sector banks. Here’s an approximate view according to the latest composition:

HDFC Bank – around 26%

ICICI Bank – around 24%

Kotak Mahindra Bank – around 12%

Axis Bank – around 10%

State Bank of India (SBI)—around 11%

IndusInd Bank – around 6%

Bandhan Bank, AU Small Finance Bank, IDFC First Bank, Federal Bank, and Punjab National Bank share the remaining 11% of the weightage.

These percentages change depending on market capitalization. So, when a bank’s market cap rises, its weightage in the index also increases. This has more influence on Bank Nifty movements.

How Bank Weightage Influences Bank Nifty Movements

The Bank Nifty movements depend directly on the performance of its top-weighted banks. Suppose if HDFC and ICICI banks rally together, the overall index tends to rise, even if smaller banks show weakness. Similarly, a sharp fall from these top banks can highly impact the entire index.

This understanding becomes valuable for intraday traders. Instead of tracking all these 12 banks, you can watch these heavily weighted banks closely for early trend signals in Bank Nifty futures and options. If the top three banks move in the same direction, it confirms the trend of the day.

Read our LinkedIn article on how Bank Nifty weightage is calculated to know more information.

Using Weightage Data for Intraday and Positional Analysis

With the help of weighted data, you will know how much each stock influence, like HDFC or ICICI bank, has on an index such as Bank Nifty. Traders can use this information to plan both short-term and long-term trades.

Weightage data for intraday trading:

Watching the price moves of heavily weighted stocks helps to predict short-term market direction. HDFC or ICICI bank moves have a quick impact on Bank Nifty moves.

Weightage data for positional trading:

Positional traders use weighted trends to identify sectoral shifts when PSU banks gain more influence due to an increase in market capital or policy support.

When traders combine these insights with Bank Nifty tips or strategies, you can make smarter, data-driven decisions. Explore our blog on how to trade Bank Nifty intraday to get more information.

Private vs. PSU Banks: Who Drives the Index More

Private sector banks dominate the Bank Nifty index due to their higher weightage. Banks such as HDFC, ICICI, and Kotak Mahindra together contribute more than 60% of the total index.

It means when these private banks move up or down, they have the most impact on the Bank Nifty’s overall movement. PSU banks like SBI and PNB have less influence. However, during policy announcements or government-related financial decisions, PSU banks can still create a short-term impact on the Index.

So, if any of the following insights are from a registered tips provider, keep in mind that private banks performance mostly decides the direction of the index.

Sectoral Shifts That Impact Bank Nifty Weightage

The weightage of banks in Bank Nifty keeps changing over time. It changes due to several factors, such as market capitalization, quarterly earnings, or new inclusions to the index.

If private banks perform well, their market value goes up, and their weightage in the index also increases. Similarly, if PSU banks perform well, it will attract more investors, and their share in the index will also increase. So, this structure ensures the index always reflects the true performance of India’s leading banks.

It is very important for traders to keep tracking these changes. This will help you to adjust your intraday and positional strategies. You can also explore our research techniques on the Bank Nifty and Nifty blog for better insights and trading decisions.

Conclusion

Understanding the weightage of banks in Bank Nifty helps traders and investors to get clarity over market movements. Also, it reveals which banks are driving the trend and how they influence the index. Whether it is for long-term sectoral outlook or intraday decisions, this knowledge can guide better trading discipline.

At The Trade Bond, we help to simplify complex market concepts for all levels of traders. To get more insights, visit our SEBI-registered stock market advisory services; you can understand the market structure before you trade. In this evolving Indian banking landscape, knowing the weightage of banks in Bank Nifty can be more useful to trade smartly.

FAQ's

How can I check the latest Bank Nifty weightage?

Yes, you can visit the NSE India official website, and under the Bank Nifty index section, you can check the weightage. Also, you can track this data daily to understand which banks are leading the movement. You can also follow The Trade Bond’s updates for simplified breakdowns of these changes.

Which banks have the highest weightage in 2025?

In 2025, private sector banks like HDFC Bank, ICICI Bank, and Kotak Mahindra Bank have the highest weightage in the Bank Nifty Index.

When does Bank Nifty weightage change?

Yes. NSE updates the weightage every few months when market values of banks change.