How to Analyse Option Chain Data for Bank Nifty Intraday Moves

Introduction to option chain data for Bank Nifty Intraday moves

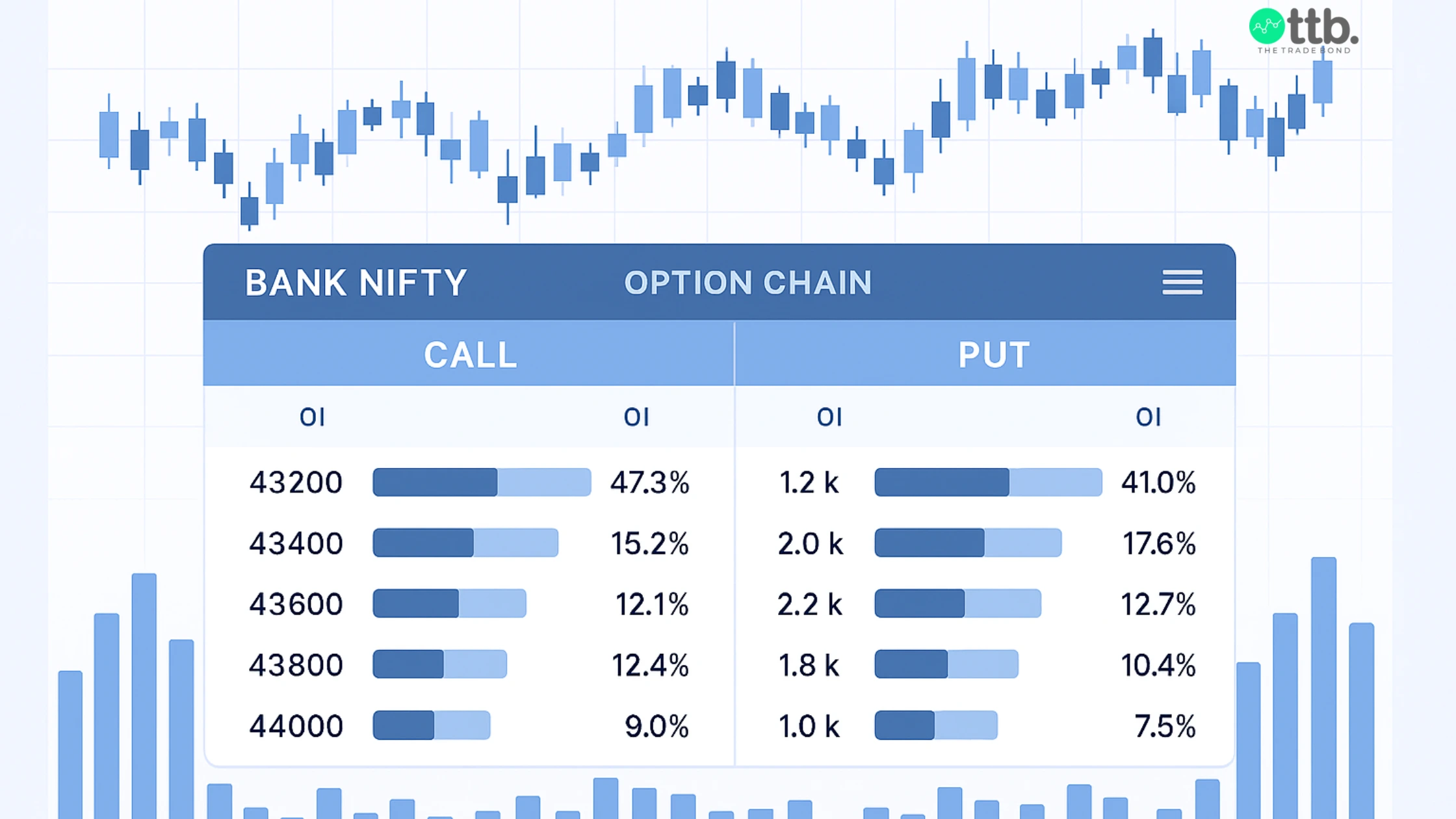

Option chain data for Bank Nifty intraday moves helps traders understand how participants are positioning themselves during live market hours. When you study price action and volume along with the option chain, it reveals sentiment and potential support and resistance zones. Also, about directional changes that guide more structured Bank Nifty trades. For intraday, Bank Nifty intraday trading information adds clarity to entries, exits, and market behavior without depending just on assumptions.

Understanding Option Chain Basics for Bank Nifty Intraday Traders

The option chain shows strike-specific open interest, volume, call activity, and put activity. Traders who are focusing on Bank Nifty intraday movement, OI acts as a reference point to locate strong zones.

PE OI buildup:

Indicates buyers defending support.

CE OI buildup:

Shows sellers are active near resistance.

These shifts help traders complement daily Bank Nifty tips and Nifty Bank Nifty tips shared through market research and outlooks.

How to Identify Real-Time Market Sentiment Using Option Chain Data

Real-time sentiment becomes visible through changes in CE and PE behavior. A steady rise in PE OI usually reflects confidence around support zones, while rising CE OI signals pressure around resistance. When the index reacts around these zones, you can connect this reading with insights shared through our blog on avoiding common intraday trading mistakes in Bank Nifty for proper decision-making.

How to Spot Trend Reversals Using Option Chain Shifts

Trend reversals begin with unusual OI movements. If CE OI starts unwinding near major resistance while PE OI reduces near support, the market may be signalling exhaustion. This aligns closely with concepts explained in our blog on how to trade Bank Nifty breakouts without getting trapped. This is where early rejection zones and changing sentiment appear before price confirms the move.

How Volume Confirms Option Chain Data for Bank Nifty Intraday Moves

Volume acts as a filter for OI changes. A strike with rising OI and strong volume suggests active participation. But if OI rises without enough volume, it may not represent meaningful interest. For Bank Nifty intraday traders, understanding this behavior during opening and mid-session hours helps create structure in Bank Nifty trades. This approach fits naturally with market observations shared by your Stock market advisor page.

How to Combine Option Chain Data with Price Action for Better Entries

Price action gives context to option chain readings. If PE OI rises around a level where bullish candles repeatedly appear, support becomes more reliable. Likewise, CE buildup paired with rejection candles reinforces resistance. Also, these patterns work well with concepts discussed in Intraday Trading Tips Using Price Action techniques that work, where traders use candle behavior and structure to refine timing.

How Option Chain Data for Bank Nifty Intraday Moves Enhances Trade Planning

Within intraday sessions, option chain analysis supports planning by defining likely reaction zones, highlighting participants’ behavior, and offering clues about whether strength is coming from buyers or sellers. Traders following Bank Nifty tips or analyzing Bank Nifty trades can use this information to stay aligned with market conditions instead of reacting emotionally.

Common Mistakes in Reading Option Chain Data for Bank Nifty Intraday Moves

Some traders react instantly to sudden OI spikes without checking volume or market structure. Others focus only on numbers or assume every OI rise signals direction. Explore our pages like Bank Nifty tips provider and Bank Nifty tips to help traders build a more disciplined framework by understanding how OI and sentiment interact with live price movements.

The Trade Bond's View

At The Trade Bond, we see Option Chain Data for Bank Nifty Intraday Moves as a tool that brings structure, clarity, and awareness to intraday decisions. When traders combine option chain shifts with volume, price action, and sound market understanding, they develop a more informed approach to Bank Nifty intraday movement. Also, this mindset encourages steady learning, disciplined observation, and a more meaningful trading process throughout live market conditions.

FAQ's

What is Option Chain Data for Bank Nifty Intraday Moves?

Option Chain Data for Bank Nifty Intraday Moves shows real-time CE and PE activity that helps traders identify support, resistance, sentiment, and intraday direction.

How does OI help in Bank Nifty intraday analysis?

Open Interest highlights where traders are adding or exiting positions. Rising PE OI indicates support zones, while rising CE OI suggests resistance pressure.

Should option chain data be used alone for Bank Nifty trades?

No, traders should combine option chain readings with price action, time-of-day behaviour, and market structure for clearer intraday decisions.