Basic Option Trading Terminology Explained for Beginners

What Basic Options Trading Terminology means for New Traders

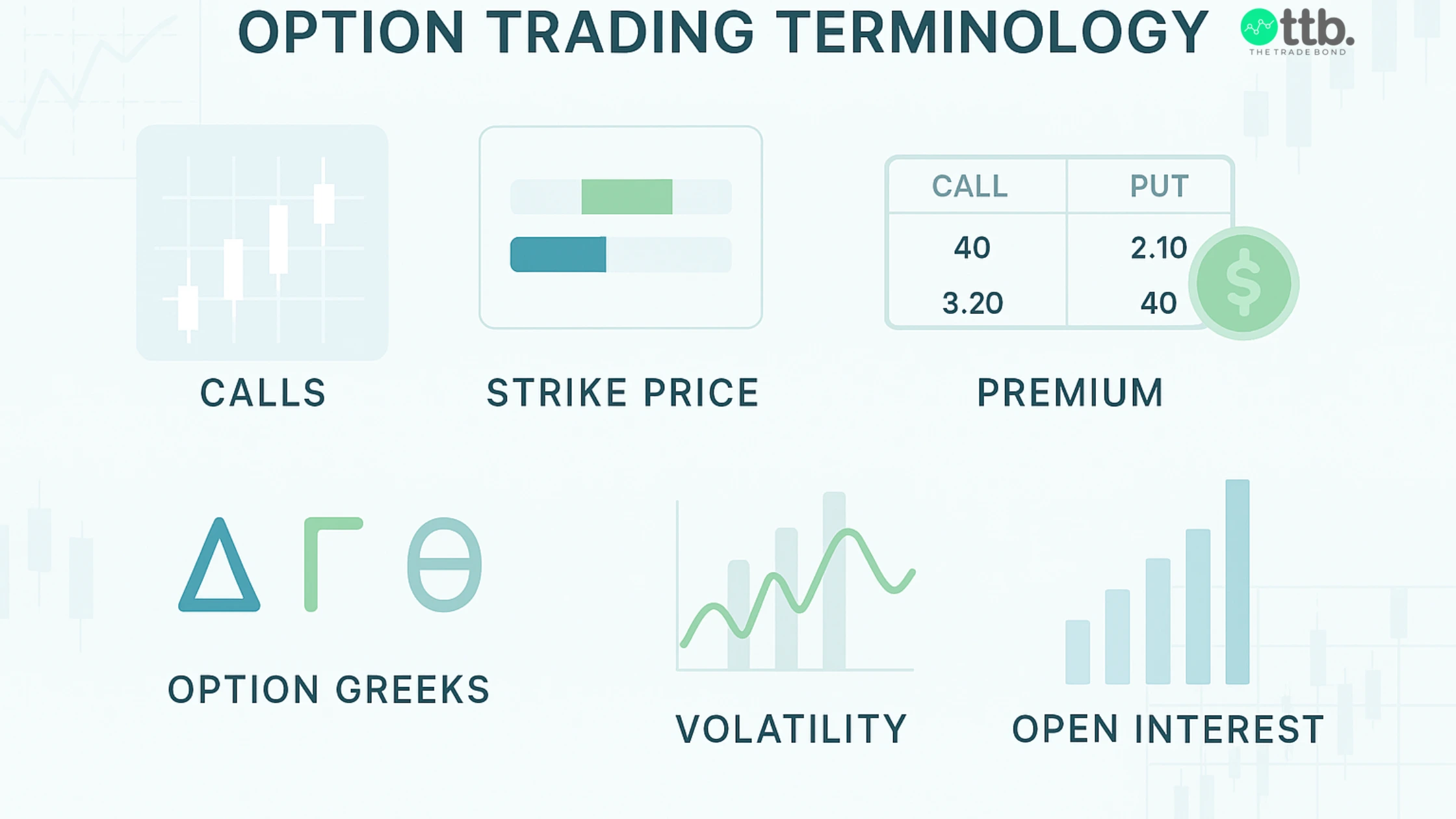

As a new trader, when you know the basic option trading terminology, options become easier. New participants should start with simple concepts and gradually move toward learning practical option trading strategies. Although this guide breaks down the core terminology in a clear and structured way. Therefore, it is helpful for traders who are exploring option trading to check out the option trading tips page. You can also learn from a reliable stock option tips provider about this terminology.

Calls and Puts: The Two Building Blocks Every Trader Must Know

Options begin with two major terms, such as Call and Put.

A call option gives the trader the right, but not the obligation, to buy an asset at a fixed price. Also, traders generally refer to a call when they expect the market to move upward.

A put option gives the right to sell an asset at a fixed price. Puts usually come into focus when traders expect downward movement.

You can explore option trading for beginners so you understand how these two instruments behave in different market phases.

How Option Pricing Works: The Factors That Change Premiums

Option premiums are influenced by various factors such as volatility, expiry, and the underlying price movement. For example, when volatility rises, premiums expand because the market expects wider price swings.

Traders should learn these factors when consulting a stock tips provider in India. Because they focus on education and research-based learning.

Why Option Premiums Move Faster on Expiry Day

As soon as the expiry day arrives, option premium values tend to move sharply due to rapid time decay. Also, this phenomenon is known as Theta decay and it affects both calls and puts.

Beginners exploring short-duration option trading strategies should understand how premiums can lose value quickly on the last trading day. Hence, learning these factors early helps traders prepare better for fast-moving expiry sessions

Liquidity Traps in Options: How Low OI Affects Your Trade

Liquidity is essential in the options market. Because when Open Interest is low, there are few buyers and sellers. Therefore, it creates a liquidity trap. In such situations, entering or exiting trades becomes difficult, and slippage increases.

As a trader, you must check liquidity parameters like OI, bid-ask spread, and volume before implementing any strategy. Also, many new traders refer to research-oriented guides or consult a stock option tips provider. Because they will explain to you better how liquidity affects execution.

Strike Price Explained: The Level That Decides Your Profitability

The strike price is the level at which you can buy or sell the underlying asset through your option. Choosing the right strike price depends on market conditions, volatility, and direction.

Those who want to learn how to select the best stocks for option trading start by studying strike selection for both intraday and positional setups. Also, it becomes easier when a trader clearly understands the relationship between strike price selection for both intraday and positional setups.

Live Market Data Terms Every Options Trader Should Know

Some essential live-market terms include:

Last Traded Price:

The most recent price at which the option traded

Bid and Ask:

Prices quoted by buyers and sellers

Implied Volatility:

Market expectation of upcoming movement

Delta, Gamma, Theta:

Option Greeks that show sensitivity to movement

These terms help traders react quickly due to changing market conditions. Especially when you explore intraday option trading approaches.

Adjustments in Options Trading: Essential Terms for Risk Control

Adjustments are methods used to realign an existing position when the market moves unexpectedly. Therefore, with some common adjustments such as shifting strikes, converting naked positions in spreads, or rolling contracts to another expiry.

Many new traders look for structured guidance from research-oriented communities or a registered advisory firm. You can check out for Sebi-registered advisory, which helps them understand regulated market practices.

Why Options Are Risky for Beginners and How to Use Them Safely

Options are complex instruments, and beginners may find it challenging to manage fast-moving premiums and volatility. Therefore, understanding these basic terms and focusing on limited-risk strategies like spreads are so helpful. Also, following responsible option trading tips can create a safer learning environment.

Beginners refer to educational blogs such as option trading tips for beginners or seek insights from a stock tips provider in India. So, you can navigate markets responsibly.

Conclusion

Understanding basic option trading terminology helps new traders build a strong foundation before they explore any strategies. Also, concepts like calls, puts, strike price, Greeks, and liquidity play an important role in shaping everyday trading decisions. When beginners combine this knowledge with disciplined market observation and structured learning, option trading will become easier. Therefore, by exploring these pages, such as option trading tips, how to select the best stocks for option trading gives traders a clear path. At The Trade Bond, our focus is to help traders learn market terms in a simple and practical way and make the right decisions. Also, they can build confidence gradually.

FAQ's

Why is learning basic option trading terminology important?

Because basic option trading terminology helps beginners understand market movement, option pricing, and risk factors before entering live trades.

How does basic option trading terminology improve risk management?

Knowing basic option trading terminology improves risk control. Therefore, traders understand how to adjust, spreads, OI, and market data signals.

How does basic option trading terminology help beginners understand premium movement?

It explains premium factors like volatility, time decay, and market direction. Also it helps beginners understand why options move quickly.